![]()

|

Priority Investment Areas |

|

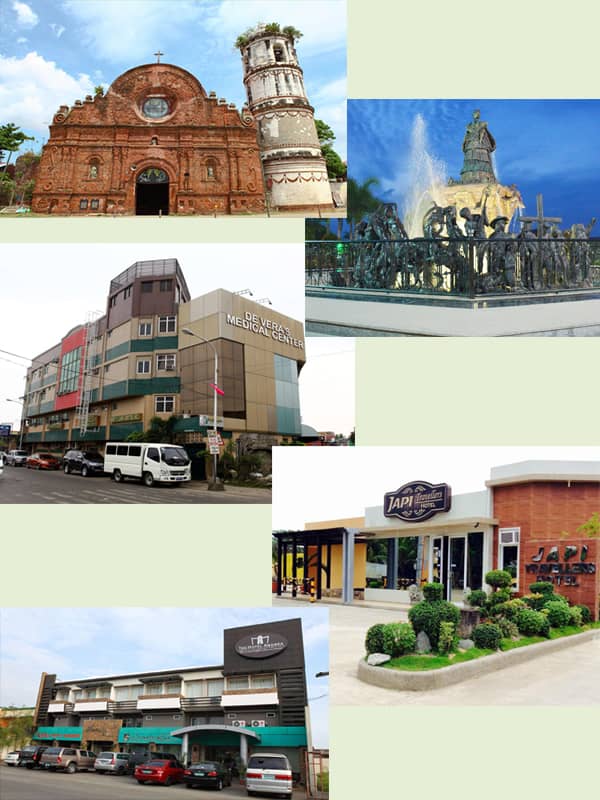

Doing business in Isabela provides investors with more than just profit gains. The province offers unique and exceptional treasures not found anywhere else – diverse natural resources, breath-taking sceneries, vibrant culture, adequate infrastructure network, and most importantly, warn and committed people. Isabela occupies a strategic location between Cagayan Economic Zone and the national capital region of the country, Metro Manila. The province has productive forestlands and watershed areas and is known as the “Hybrid Cord and Rice Champion Producers of the Philippines.” As the home of Magat Dam, the largest dam in Southeast Asia, Isabela is a major source of power and water supply for Northern Luzon and part of Metro Manila. It is also rich in mineral resources while having a lengthy range of coastlines totaling 147 kilometers from Maconacon to Dinapigue that are abundant in aquatic resources. Foreign and local investors are invited to invest directly in greenfield projects and operating businesses by establishing new companies, subsidiaries or joint ventures in the following Priority Investment Areas of Isabela:

Forest-Based Industries

Tourism Development

Gifts, Toys and Housewares

Support and Allied Services/Knowledge-Based Industries

|

|

Regulatory Framework & Tax Incentives |

|

Issued by the Philippine Board on Investments (BOI) annually, the IPP is a list of priority investment areas eligible for tax incentives in consultation with related government agencies and the private sector. Even if the activity is not listed in the IPP, an enterprise may still be entitled to incentives as long as at least 50% of production is for export (in the case of Filipino-owned enterprises), or at least 70% of production is for export (if majority foreign-owned enterprises or those with more than 40% foreign equity). In certain instances as indicated in the IPP, the BOI may completely or partially limit the incentives available to export products. Under Book I of the Omnibus Investments Code, BOI-registered enterprises are given incentives in the form of tax exemptions and concession, as follows:

Investment Incentives

Registered Enterprises may avail of the following Non-Fiscal Incentives:

Prospective Investors: 5 Simplified Steps in Opening a Business in Isabela

|

|

Forex Repatriation & Investment Protection |

|

There shall be no expropriation by the government of the property represented by the investment of property of enterprises except for public use or in the interest of national welfare and defense, and upon payment of just compensation. In such cases, foreign investors or registered enterprises shall have the right to remit sums received as compensation for the expropriated property in the original currency at the prevailing exchange rate. Furthermore, there shall be no requisition fo the same property except in the event of war or national emergency and only for the duration. Just compensation for the requisitioned property may also be remitted in the original currency at the prevailing exchange rate. In addition, investors are accorded the following under various agreements entered into by the Philippines and foreign states:

|

|

Foreign Investment Channels |

|

Foreign nationals are allowed to invest 100% equity in companies engaged in business subject to restrictions as prescribed in the FINL, a shortlist of investment areas which may be opened to foreign investors and/or reserved for Filipino citizens. If the proposed venture is not in an activity listed in the FINL, foreigners may invest up to 100% capital in a domestic entity if the paid-up capital is at least US$200,000.00, which may be lowered to US$ 100,000.00 if advanced technology is introduced or at least 50 direct employees are employed. With or without incentives, doing business in the Philippines requires prior registration with the Securities and Exchange Commission (SEC) for corporations or partnerships, or the Department of Trade and Industry (DTI) for sole proprietorship. Other types of business enterprises that may be set up under foreign laws that require SEC/DTI registration are branch offices, representative or liaison offices, regional headquarters, and regional operating headquarters. After SEC registration, enterprises seeking to remit profits and dividends or repatriate capital abroad may register their inward remittance with the Bangko Sentral ng Pilipinas (BSP). For this purpose, BSP rules and regulations covering procedures for registration of foreign investments are observed. The Foreign Investments Act recognizes the rights of former natural born Filipinos. They are granted the same investment rights as Filipino citizen in activities such as cooperatives, thrift banks, rural banks and financing companies. Those who have the legal capacity to enter into a contract under Philippine laws may be transferees of private land to be used for business or other purposes up to a maximum area of 5,000 square meters in the case of urban land or three hectares in the case of rural land.

|

Agri/Aqua-Based Industries

Agri/Aqua-Based Industries Infrastructure Facilities

Infrastructure Facilities The Government of the Republic of the Philippines has implemented a liberal program of fiscal and non-fiscal incentives to attract foreign capital and technology that complement local resources. Under the Omnibus Investments Code of 1987 (Executive Order 226), investors may enjoy certain incentives when investments are made in preferred areas found in the current Investment Priorities Plan (IPP).

The Government of the Republic of the Philippines has implemented a liberal program of fiscal and non-fiscal incentives to attract foreign capital and technology that complement local resources. Under the Omnibus Investments Code of 1987 (Executive Order 226), investors may enjoy certain incentives when investments are made in preferred areas found in the current Investment Priorities Plan (IPP). Under Article VII, Sec. 18 on the proposed ordinance enacting the Investment and Incentive Code of Isabel, subject to the approval of the Board, a registered enterprise may be granted the following fiscal incentives:

Under Article VII, Sec. 18 on the proposed ordinance enacting the Investment and Incentive Code of Isabel, subject to the approval of the Board, a registered enterprise may be granted the following fiscal incentives:

Foreign investors have the right to repatriate the entire liquidation proceeds of their investment in the currency in which the investment was originally made at the exchange rate prevailing at the time of repatriation. They also have the right to remit their earnings from the investment or such sums as may be necessary to meet the payment of interest and the principal on foreign loans and obligations arising from technological assistance contracts.

Foreign investors have the right to repatriate the entire liquidation proceeds of their investment in the currency in which the investment was originally made at the exchange rate prevailing at the time of repatriation. They also have the right to remit their earnings from the investment or such sums as may be necessary to meet the payment of interest and the principal on foreign loans and obligations arising from technological assistance contracts. Anyone, regardless of nationality, is welcome to do business and invest in the Philippines, in almost all areas of economic activities provided these are not listed in the Foreign Investments Negative List (FINL) of the Foreign Investments Act of 1991 (Republic Act 7042, as amended by Republic Act 8179).

Anyone, regardless of nationality, is welcome to do business and invest in the Philippines, in almost all areas of economic activities provided these are not listed in the Foreign Investments Negative List (FINL) of the Foreign Investments Act of 1991 (Republic Act 7042, as amended by Republic Act 8179).